How We Work

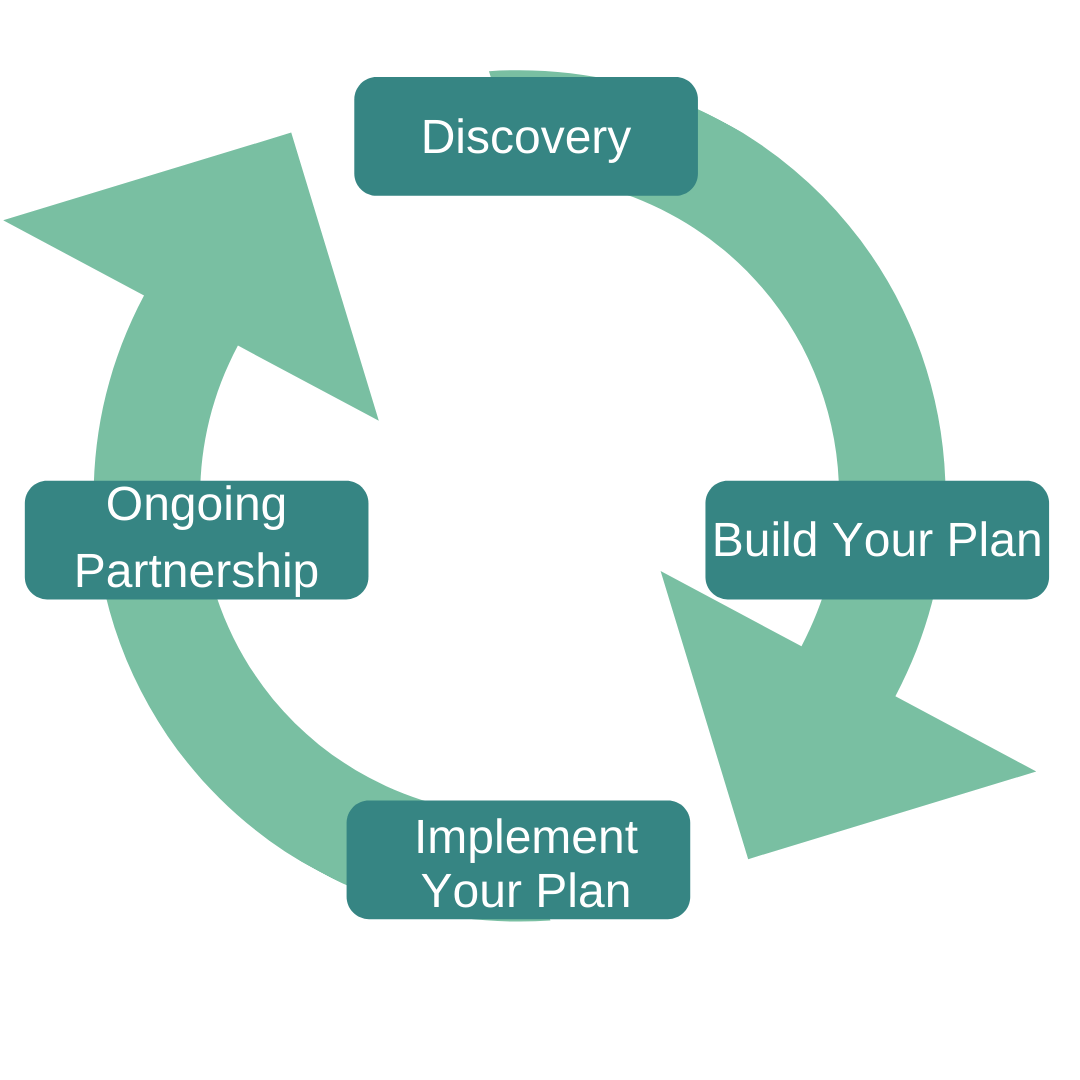

We utilize a simple 4 step process

Traditional Individual and Family Planning

1. Discovery – First Meeting

1. Discovery – First Meeting

We learn about your financial situation and find out how we can help you. We discover and prioritize your goals.

2. Build your Plan

We gather any important documents, research financial options, and evaluate your financial situation including assets, investments, obligations, and monies in order to build your financial plan.

3. Implement your Plan

We implement and continuously manage your financial plan. Including short-term and long-term goals.

4. Ongoing Partnership

We meet regularly and make sure your financial plan remains on track with your goals.

Special Needs Financial Planning

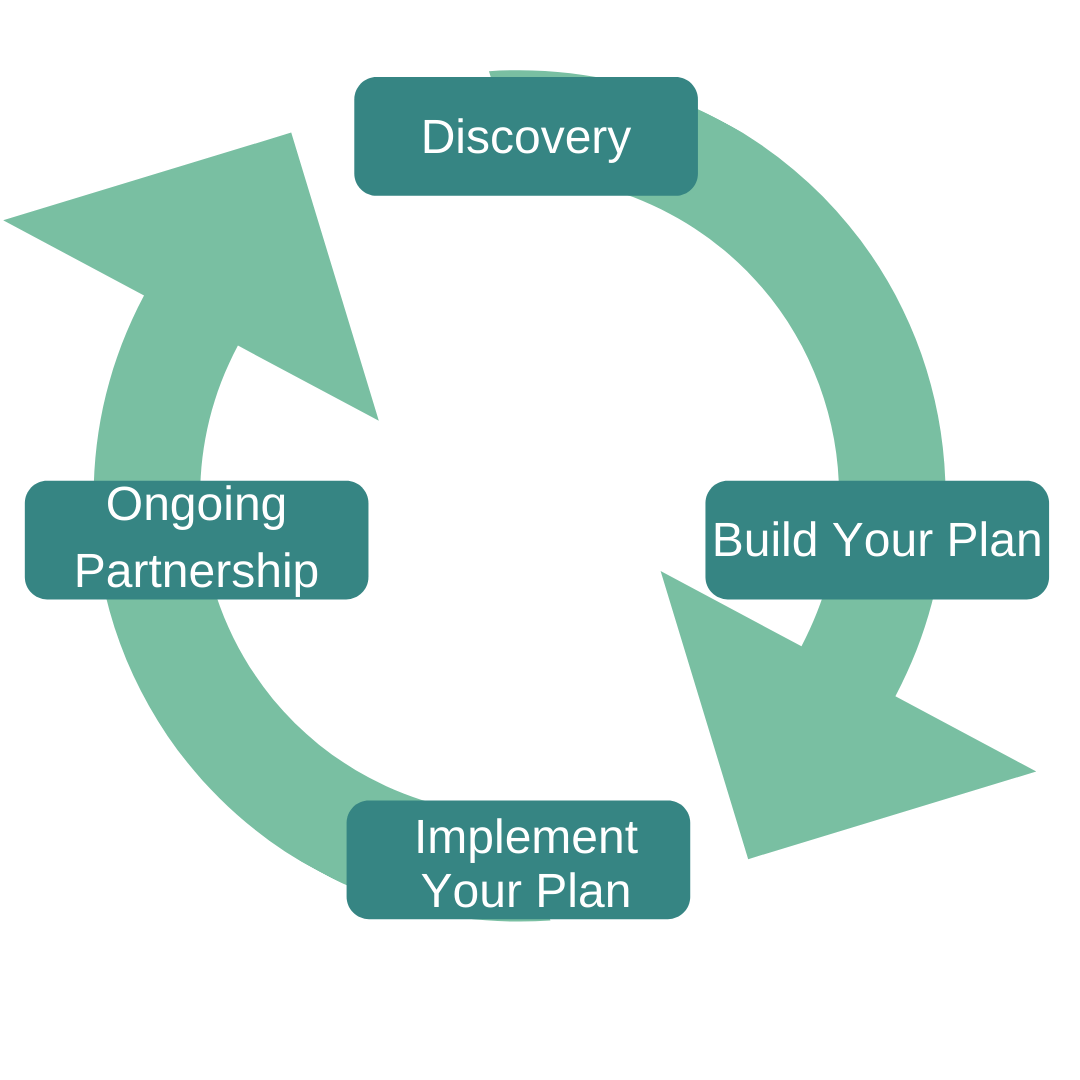

1. Discovery – First Meeting

1. Discovery – First Meeting

We learn about your financial situation and find out how we can help you. We discover and prioritize your goals.

2. Build your Special Needs Financial Plan

We gather any important documents, research financial options, and evaluate your financial situation including assets, investments, obligations, and monies in order to build your special needs financial plan.

3. Implement your Special Needs Financial Plan

We implement and continuously manage your special needs financial plan. Including short-term and long-term goals.

4. Ongoing Partnership

We meet regularly and make sure your special needs financial plan remains on track with your goals.